Private Markets Annual Update

By Crescent Team

A look into how the year in private markets unfolded and thoughts for a successful 2023

KEY OBSERVATIONS

• The pace within private markets – from fundraising to deal activity – moderated over the back half of 2022 following a frenetic multi-year period.

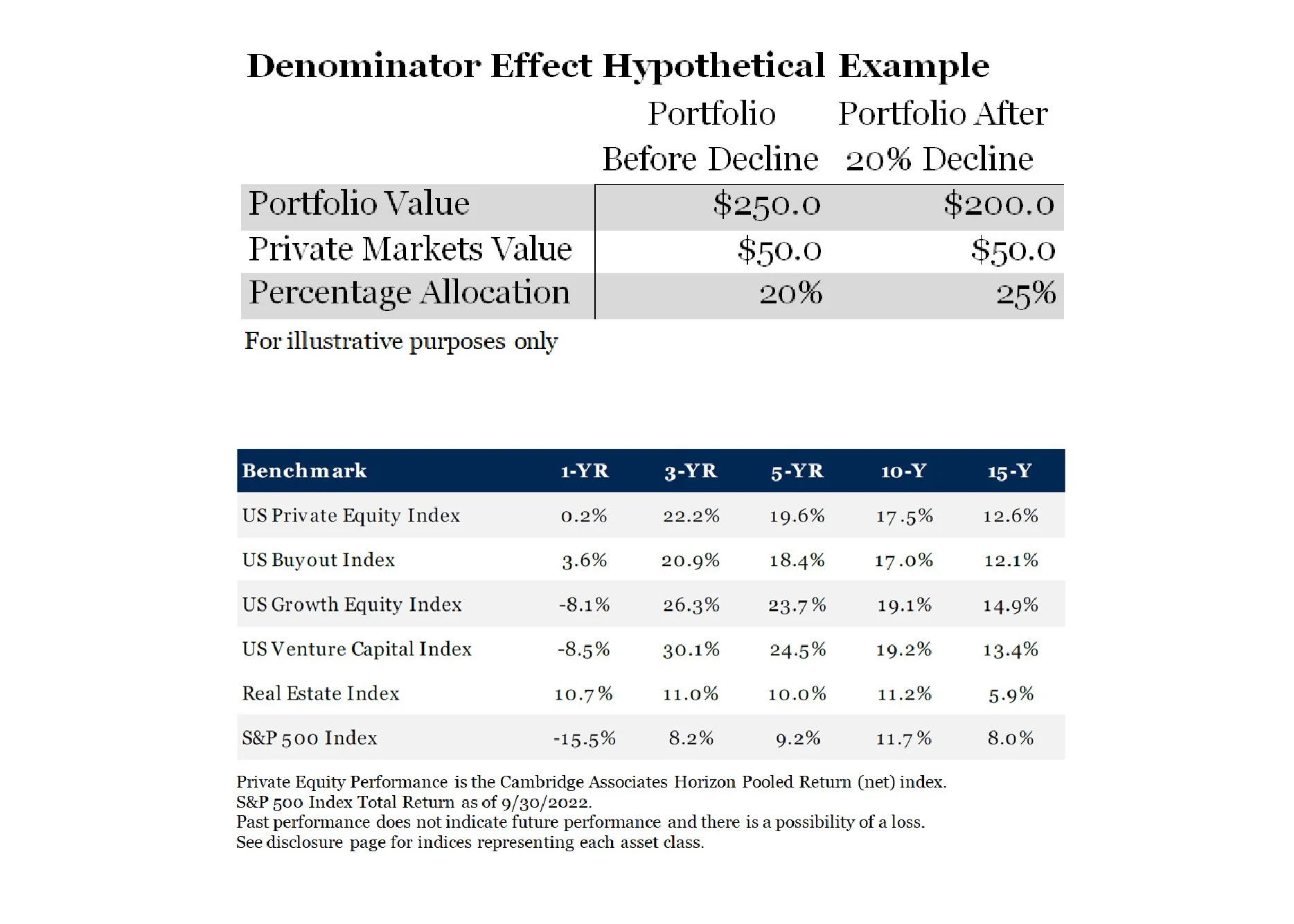

• Many investors grappled with the denominator effect as declining portfolio values led by sharp declines in public markets were met with lagged valuations in private markets, creating a rise in those allocations. Programmatic deployment, vintage year diversification and consistent planning help to combat these periods and stay on track long-term.

• As we look forward, we see a market of “haves” and “have nots” where sought-after sponsors have an easier time raising capital than peers and certain limited partners are better positioned to take advantage of the opportunity set.

• Overall, we remain convicted in the asset class and in our philosophical approach that prioritizes operational prowess and capitalizing on market inefficiencies.

INTRODUCTION

For many, 2022 was a year of resetting expectations. Public markets – both equity and debt – were faced with pressure as a result of persistent inflation and corresponding interest rate hikes. Investors were left with few places to hide as the market adjusted to the ramifications of a new era. The capital markets disruption also had notable, if not material, impacts on the private markets. Fundraising fell, deal volume fell, exits slowed and the delay, as well as less drastic changes in valuations resulted in a meaningful denominator effect for many limited partners (“LPs”). There were also multiple acute events that sent shocks through the market such as the blowup of FTX or, more recently, the downfall of Silicon Valley Bank (“SVB”). These gripping episodes, while not necessarily abnormal in a historical context, highlight the importance of diligence, governance and diversification.

FUNDRAISING ACTIVITY

Fundraising cooled in the back half of 2022 but remained strong overall by historical standards. Fundraising across all private markets strategies fell 22% to $1.2 trillion.(1) Private equity and venture capital fared better, while private real assets, credit and fundraising within fund of funds and secondaries took a greater hit. Within private equity specifically, fundraising continued to outpace any year prior to 2019. The slower pace by many pensions and some endowments was largely offset by family office participants. Consistent with previous years, the largest funds in the market continued to raise the majority of the capital. Funds over $1 billion raised 80% of the overall capital.(2)

Unsurprisingly, the amount of time it has taken funds to close has increased rather dramatically. On average, for funds that had their final close in 2022, it took 16.4 months from start to finish. That is the longest average fundraising period since 2011. We see this metric continuing to rise in 2023 as the first half of 2022 was only partially impacted and funds that are still in the market are excluded from that calculation. As we discuss opportunities with peer investors, many are delaying commitment decisions where possible, and many GPs are recognizing that they need to distribute capital from prior funds back to LPs or have a seeded portfolio to attract and incentivize LPs to move forward.

It is worth highlighting, however, that the top 25 percent of funds that are fastest to close – i.e., seeing the highest demand – remained at nearly an all-time low of 5.2 months to close. This means the market for highly sought after funds is as competitive as it has ever been, and we believe this trend continues and even intensifies. As much as anything, this is an underlying signal that, regardless of the market environment, the importance of having a dedicated team to secure access to the top managers and continually navigate the market is invaluable.

Given these dynamics, the number of funds currently in market has ballooned to over 8,000 according to Preqin.(3) This is more than double the long-term averages. It’s likely that many of these firms miss their fundraising targets and feasible that there are many who miss by a wide margin. With the continued theme of “have” and “have nots,” it’s possible, maybe even probable, that “zombie funds” emerge where firms do not have enough management fee income to support the growth they anticipated or need to scale down resources because they hired ahead of anticipated growth. From a diligence standpoint, it is important to assess the ability of a firm to have enough revenue to sufficiently staff investment and operations teams with “A+” talent. It is also vital to understand the types of organizations (other limited partners) that will be investing alongside our clients. Both diligence points help develop confidence that a particular firm can raise an appropriate amount of capital for the opportunity set and operate successfully.

DEALMAKING

On theme, deal flow in 2022 is expected to be lower than 2021. While still awaiting finalization of fourth quarter deal activity, if we annualize from the first three quarter of the year, we can estimate that overall deal value fell by approximately 10% while deal volume fell by 3%.(4) As discussed earlier, we believe the sharp rise in interest rates was the primary factor. Across the market, higher rates either led to levered buyers re- penciling prices based on greater interest payments or growth buyers rethinking the value of future dollars. In either case, the buyers generally wanted lower prices and sellers were less inclined to budge. It is also worth noting that while 2022 is certainly off pace from 2021, it remains an incredibly high year for deal activity by historical standards. It is true that deals are taking an extra few weeks or months to close, but they are still closing and the market is by no means gridlocked.

As the market and valuations adjusted, the underlying data highlights that the makeup of deals also shifted. In 2022, 78% of buyout deals completed were add-ons – rather than new or “platform” investments.(5) This is more than a 5% increase in share from the prior year.(6) While “buy and build” is a common and formidable strategy, there are certainly some firms who came to the realization that they were going to need to attempt to blend down valuations on platforms they paid full price for in the years past. The potential result of more add-ons is longer hold periods for investors and therefore a longer time to liquidity.

As markets became volatile, interaction between private markets and public markets increased. Through the first three quarters of 2022, there had been as much deal value in take-privates as there was for all of 2021. Much of this activity was centered around the technology space with large, specialist private equity funds leading the charge. One of the most noticeable divergences from years past was the lack of IPO exit activity. Throughout 2022, there were only 42 public listings totaling $9.1 billion in exit value.(7) That is 86% and 99% lower, respectively when compared with 20228. For the past several years, major tech IPOs became normal. In 2022, not a single tech IPO raised more than $1 billion while 2021 had 15 of them!(9)

REAL ASSETS AND DEBT

Real assets and debt were meaningful topics of discussion over the course of 2022 but were relatively less successful in raising capital. Real assets fundraising, which includes real estate and infrastructure, was down 34% while private debt was down 20%.(10) Within real estate, the market broadly continues to focus on multifamily and industrial as they view the primary demand factors for both of those property types to be stable while the office market continues to have less consensus. In addition, non-traditional property types, such as healthcare and data centers, continue to garner interest. Within broader infrastructure, the market has shifted dramatically from traditional energy to energy transition – with less of a focus on a particular type of energy and more on the continuum to more sustainable sources.

The private debt markets continue to be a topic of interest for many investors and the market has grown significantly in recent years. This is a function of longer-term trends that stemmed from the financial crisis with banks doing less lending and private lenders stepping in to fill that void. In 2021, private debt surpassed real estate (holding real estate and real assets as separate asset classes) in assets under management and continues to hold that spot. As capital has flowed into the space, the average fund size has more than doubled in the past two years, from ~$600 million to nearly $1.3 billion.(11) For comparison, the average private equity fund has increased approximately 46% over the past two years. As we know, larger funds must either deploy capital into more deals (which requires a larger team) or they must invest in larger deals.

VALUATIONS AND PERFORMANCE

Valuations within private markets have been a distinct topic of discussion. While it is accepted that private markets valuations are delayed in reporting and tend to lag public markets, rapid changes in liquid markets create a more noticeable divergence and can result in challenges in assessing the private markets exposure and potentially comparing performance across funds. This instance is commonly referred to as the denominator effect and the results are highlighted in the chart above. Our advice and suggestions are relatively straightforward in these instances – don’t overreact to shorter-term movements. As part of the initial and ongoing planning, investors should assess the appropriate level of liquidity needed within the portfolio, then adjust long-term commitment planning as a result. Too often, investors will dramatically reduce or eliminate commitments during these periods of divergence which results in greater inconsistency of longer-term cash flows in this part of the portfolio. Long-term programmatic deployment with diversification across vintage year, strategy, and sector can help combat the need to make drastic changes to annual commitment pacing.

Performance within private markets highlighted similar divergences noticed in public markets – namely a pullback in high growth investments. As such, venture capital and growth equity both declined on the 1-year trailing basis while buyout (representative of positive cash flowing businesses) remained resilient. Going forward, we continue to think that portfolio marks will adjust to the current environment. For some funds, that may mean moderate write-downs, while other will continue to recognize gains.

IN CLOSING

Like many asset classes, 2022 was a downshift for private markets. Fundraising, dealmaking and performance were all impacted. It was a year where many investors took a step back to reevaluate their programs – from commitment pacing to portfolio construction and fund selection. We believe that to be a prudent assessment in all years – not just the volatile ones. Our team’s philosophical approach encourages us to lean in with confidence despite the current environment. We prefer firms and funds that have distinct operating capabilities and deeply understand the businesses they own and sectors they invest so that they can navigate difficult markets and business cycles. In addition, having an appropriately sized fund that fits the resources of the firm and allows the team to take advantage of fragmentation and inefficiency leaves more opportunities for value creation. Lastly, alignment is critical in long-duration and illiquid structures.

Overall, this is a market environment that reminds us that a comprehensive program inclusive of planning, thoughtful portfolio construction, and an ability to garner differentiated access is what optimizes client outcomes.

For more information, please contact the professionals at Crescent Wealth Advisory.

Download a PDF of this blog.

1) Pitchbook as of December 31, 2022

2) Pitchbook as of December 31, 2022

3) Preqin 2023 Global Private Equity and Venture Capital Annual Reports

4) Pitchbook Q3 Private Equity Report

5) Pitchbook as of September 30, 2022

6) Pitchbook as of September 30, 2022

7) Pitchbook as of December 31, 2022; https://pitchbook.com/news/articles/ipo-recovery-private-equity

8) Pitchbook as of December 31, 2022; https://pitchbook.com/news/articles/ipo-recovery-private-equity

9) CNBC Article: “Tech IPO Market Collapsed in 2022 and Next Year Doesn’t Look Much Better; December 29, 2022

10) Pitchbook as of December 31, 2022

11) Pitchbook as of December 31, 2022

DISCLOSURES AND DEFINITIONS

Comparisons to any indices referenced herein are for illustrative purposes only and are not meant to imply that actual returns or volatility will be similar to the indices. Indices cannot be invested in directly. Unmanaged index returns assume reinvestment of any and all distributions and do not reflect our fees or expenses.

• US Private Equity Index is a horizon calculation based on data compiled from 1,482 US private equity funds, including fully liquidated partnerships, formed between 1986 and 2022.

• US Buyout Index is a horizon calculation based on data compiled from 1,070 US buyout funds, including fully liquidated partnerships, formed between 1986 and 2022.

• US Growth Equity Index is a horizon calculation based on data compiled from 412 US growth equity funds, including fully liquidated partnerships, formed between 1986 and 2022.

• US Venture Capital Index is a horizon calculation based on data compiled from 2,322 US venture capital funds, including fully liquidated partnerships, formed between 1981 and 2022.

• Real Estate Index is a horizon calculation based on data compiled from 1,305 real estate funds, including fully liquidated partnerships, formed between 1986 and 2022.

• The S&P 500 Index is a capitalization-weighted index designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MATERIAL RISKS DISCLOSURES

• Real Assets can be volatile and may include asset segments that may have greater volatility than investment in traditional equity securities. Such volatility could be influenced by a myriad of factors including, but not limited to overall market volatility, changes in interest rates, political and regulatory developments, or other exogenous events like weather or natural disaster.

• Private Equity involves higher risk and is suitable only for sophisticated investors. Along with traditional equity market risks, private equity investments are also subject to higher fees, lower liquidity and the potential for leverage that may amplify volatility and/or the potential loss of capital.

• Private Credit involves higher risk and is suitable only for sophisticated investors. These assets are subject to interest rate risks, the risk of default and limited liquidity. U.S. investors exposed to non-U.S. private credit may also be subject to currency risk and fluctuations.

• Private Real Estate involves higher risk and is suitable only for sophisticated investors. Real estate assets can be volatile and may include unique risks to the asset class like leverage and/or industry, sector or geographical concentration. Declines in real estate value may take place for a number of reasons including, but are not limited to economic conditions, change in condition of the underlying property or defaults by the borrow.